Consulting firm Drury is understood to have predicted that Maersk will face a new reality this year after delivering record profits in 2022, meaning it could wage a price war with MSC, its disbanded 2M alliance partner.

With too many half-empty vessels, more competition for customers and an ambitious logistics strategy, Maersk must survive its first real test. 2023 could be a very challenging year for Maersk and its new CEO Vincent Clerc.

On the positive side, the company reported a total net profit of $29.3 billion for 2022, a record profit in Danish business history, according to its 2022 results released on February 8. (Check out: Maersk reports strong 2022 results with $81.5 billion in revenue! But 2023......)

But with rates and volumes falling, the container market, which has been a boon to shipping lines over the past two years, is shrinking fast. Several shipping analysts said this was bound to hurt Maersk's revenues this year and next.

Xeneta's latest data on contract negotiations between shippers and customers shows that spot rates have been falling for a long time, and long-term contract prices are now falling.

And changes in the market are just one factor. 2023 will also be the first real test of Maersk's ambitious logistics strategy, Drury notes in a new analysis.

Photo: Maersk

The main reason was the end of the eight-year 2M alliance with rival MSC, the world's leading container shipping line. The partnership has been active since 2015, but the two sides announced a few weeks ago that they would disband in early 2025. (See previous content: Blockbuster! 2M Alliance, the world's largest shipping alliance, announced its dissolution)

"The dissolution of the 2M alliance is ultimately the result of a clash of corporate strategies, which begs the question: which model is right?" "Drury said.

Since 2019, Maersk has completed major acquisitions of logistics companies to expand shipping and port terminal activities, including land transportation as well as warehousing and customer service.

Maersk said its integration strategy will transform the company into a comprehensive, customer-facing door-to-door logistics integration service provider. The logistics business will also underpin the group's overall earnings at a time when the sensitive container market is under pressure.

Maersk has spent about $7 billion over the past four years acquiring Logistics companies including LF Logistics, Pilot Freight Services and Senator International.

Maersk has acquired the following logistics companies in recent years:

Vandegrift: February 2019 -- Price unknown

Performance Team, North America's leading warehouse and distribution logistics giant: February 2020 -- $545 million

European trade and Customs management Services company KGH Customs Services: July 2020 - $279 million

European and American e-commerce logistics giant Visible SCM& B2C Europe: August 2021 - Price unknown

Grindrod, South African freight and financial services company (51%) : November 2021 -- $13 million

SENATOR INTERNATIONAL, German air and maritime logistics services provider: November 2021 -- $644 million

LF Logistics: December 2021 -- $3.6 billion

Pilot Freight Services, leading U.S. provider of cross-border logistics solutions: February 2022 - $1.8 billion

Martin Bencher Group, Danish project logistics company: August 2022 -- $61 million

The departing MSC followed a very different strategic trajectory. The shipping company is investing billions of dollars to expand capacity by buying and leasing used vessels and placing a record number of new shipbuilding orders at shipyards.

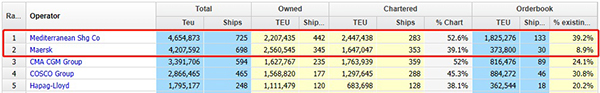

This aggressive growth plan resulted in MSC overtaking Maersk as the world's largest container liner in January 2022. According to Alphaliner, MSC's current order book for new shipbuilding increased to 133 vessels with a capacity of 1.82 million TEU. Maersk, by contrast, has ordered just 30 ships with a capacity of 373,000 teUs.

Source of data:Alphaliner

Drury noted that MSC is gradually growing in size, allowing the company to steadily manage and better utilize its growing fleet and service network. The problem is that MSC has decided to go full steam ahead at a time when the container market has peaked and is declining at an increasing rate.

The launch of new container ships will force an increase in capacity beyond demand. Barclays, the investment bank, estimates that global container fleet capacity will increase by 11 per cent this year and by 2025 will be 30 per cent higher than before the pandemic.

"MSC seems to think it can make better use of these ships without being constrained by partners with different priorities," Drury said. But there is a risk that the MSC will revert to its old market share and low-cost operating model due to the need to increase ship loading rates, which could destabilise the market.

If Maersk moves and competes with MSC on price, it will be bad for Maersk. "Maersk has invested a lot of money and energy in its integration strategy and it's hard to see it giving up now."

Mr Drury said Maersk's future could be in question without a shipping alliance such as 2M to back it up. Maersk is too small to operate independently, but too big to join one of the other two shipping alliances. Even if Maersk tried to do so, competition regulators would probably step in.

Lars Jensen, analyst and founder of shipping consultancy Vespucci Maritime, predicted that as MSC will take delivery of a large number of new ships, the company will increasingly launch its own service.

"Moreover, the dissolution could lead to a more direct commercial confrontation between MSC and Maersk, with each struggling to retain its own customers and potentially 'poach' customers from its partner in a gradual break-up."

Maersk's logistics strategy may be fruitful, Mr Drury reckons, but it also carries clear risks, with several pitfalls. It noted that one criterion for success was to properly integrate the many acquired logistics companies into the group's operations, which was "a difficult task for any large company".

Management is required to ensure that collective organizations provide services to customers in a uniform manner, while also keeping an eye on prices and all parts of the supply chain. Success will also require skeptical customers to embrace the concept of an integrated door-to-door logistics solution.

"Previous attempts by shipping companies to expand their business have often been disappointing, but new technology has raised hopes that this time things could be different." Drury commented.

Maersk said of the 2M alliance termination notice that times have changed and so has the strategy.

The 2M alliance, created by the world's leading container shipping line in 2015, aims to ensure that a series of new super-large container ships with a capacity of 20,000 TEUs can be fully loaded to improve load rates through space sharing.

Today, Maersk has different needs, said Johan Sigsgaard, chief product officer and executive vice president of Maersk Marine. "The 2M alliance was a product of the space sharing agreement in the shipping situation in 2015, but it is no longer suitable because what we need is a more independent Maersk brand." "Today, we are focusing on integrating the Marine and land service networks," he said.