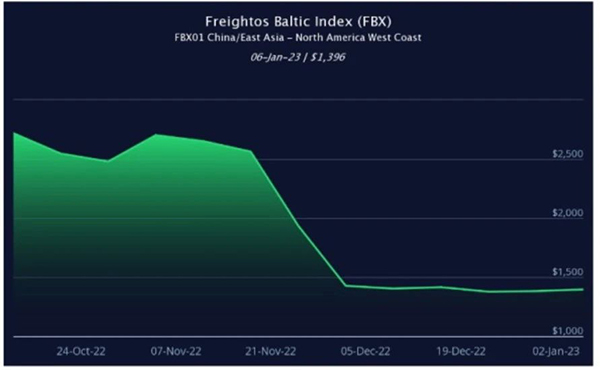

Container shipping rates from Asia to the US are basically stable ahead of the Chinese Lunar New Year, indicating that demand for maritime transport is returning to normal from the continuous surge of the past two years, shipping industry reported.

In fact, the normalization of container imports into the United States and the easing of congestion at U.S. ports are the main reasons for the stabilization of container rates.

Judah Levine, head of research at Freightos, said a combination of rising U.S. inventories and slowing demand from some consumers since the second half of 2022 has all but eliminated the small spike in freight volumes and spot prices that usually occurs before the Chinese New Year.

"Asian-west Coast container rates are 11% lower than they were in January 2020," Judah Levine explained. Rates from Asia to the East Coast of the United States fell sharply from a year earlier, down 84 percent from a year earlier.”

Freight rates on routes from China and East Asia to Europe have also levelled off, according to the Drewry World Container Index, with Shanghai to Genoa falling slightly last week and Shanghai to Rotterdam rising slightly on the trade route.

The National Retail Federation estimates that the pandemic surge may be over, as evidenced by a 10% drop in imported cases in December from a year earlier. However, the NRF predicts that the number of imported cases will gradually increase in the second half of this year.

Jonathan Gold, vice president of supply chain and customs policy at the NRF, said, "Ports reached their limits and exceeded them, but caught their breath as persistent inflation and high interest rates slowed consumer demand.”

For now, congestion has largely eased in parts of the West Coast, but continues at ports in the US Gulf and East Coast, although the number of ships waiting to unload at those ports has also decreased.

The number of container ships in the port of Savannah has dropped to 12, compared with three in New York and six in Houston, according to data from Shipping Industry Network strategic partner Shishibo. In the West, Los Angeles, Long Beach, Portland, Tacoma and other ports dropped to 0.

According to the shipping industry network, Yuvraj Narayan, chief financial officer of DP World, said in the World Economic Forum held recently in Davos that the freight rate of the container market will continue to fall in the coming year. He expects freight rates to fall a further 15% to 20% in 2023, with the worst likely yet to come as demand slows.

Yuvraj Narayan further explains that the first signs of a sharp drop in demand are clear. The International Monetary Fund and others have cut their forecasts for economic growth, and rates on some routes have fallen sharply and are down 20% to 50% from last year's peaks, driven by three of the most important factors: the pandemic, inflation in Europe due to soaring energy prices, and disruptions in global supply chains.

He added that these market disruptions will continue due to the Russia-Ukraine conflict and sanctions against Russia.